The finance ministry has asked the Direct Tax panel to revise the existing income-tax slabs, especially in the 20 percent bracket, said a senior government official privy to the development.

According to Jaitley, the current tax rates are ambiguous in nature, especially the lower slabs.

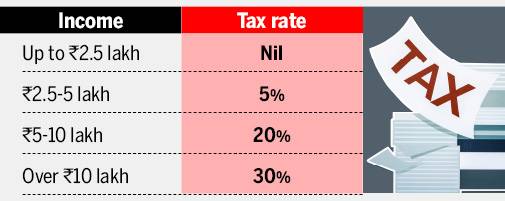

Under the current I-T slabs, an income of up to Rs 2.5 lakh is exempt from tax, those earning up to Rs 5 lakh pay 5 percent, and those earning up to Rs 10 lakh have to pay 20 percent tax.

The finance ministry has asked the direct tax panel to revise the existing income-tax slabs, especially in the 20 percent bracket, said a senior government official privy to the development. The group has sought three months to incorporate the suggestions.

This suggestion was given when the force for re-writing direct tax legislation met the Finance Minister Arun Jaitley yesterday, a day ahead of the scheduled submission of the DTC draft report.

According to Jaitley, the current tax rates are ambiguous in nature, especially the lower slabs. As suggested we will work towards harmonizing the tax rates, currently prone to interpretation. We will seek more expert voices and weigh the situations to incorporate the changes in line with the suggestions we have received.

Under the current I-T slabs, an income of up to Rs 2.5 lakh is exempt from tax, those earning up to Rs 5 lakh pay 5 percent, and those earning up to Rs 10 lakh have to pay 20 percent tax. Those with income above Rs 10 lakh have to pay 30 percent tax.