Profitability Ratios | Gross Profit Margin | Return On Total Assets | Return On Equity

The financial ratios are primarily tools for turning the date enclosed in financial statements into information used by managers and executives to better comprehend what is happening in a company.

Financial ratios are highly advantageous indicators of an organisation’s performance as well as financial environment.

Financial ratios are typically used in the process of analysing trends and also comparing the organization’s financial position to other firms.

In few instances, an effective analysis conducted by financial ratios can help to predict the forthcoming bankruptcy or economic failure.

Financial ratios can typically be grouped according to the data they make available.

You Should Remember

Financial ratios can typically be grouped according to the data they make available. However, there are a few important yet frequently used ratios as mentioned below:

Liquidity ratios,

Asset turnover ratios,

Financial leverage ratios,

Profitability ratios,

Dividend policy ratios.

Liquidity Ratios | Current Ratio | Working Capital Ratio | Quick Ratio

Financial Leverage Ratios | Debt | Total Assets | Equity | Times Interest Earned

Dividend Policy Ratios | Dividend Yield | Payout Ratio | Key Procedural Aspects

Profitability Ratios

Profitability ratios specify the profit earning capacity of a company. The profitability ratios are fundamentally used to evaluate how effective an organisation has been in accomplishing its overall profit targets, specifically in relation to the Resources invested.

Several measures of profitability relate an organisation’s earnings to its sales, assets or equity. Profitability ratios are among the most closely observed and extensively cited financial ratios.

Profitability ratios propose a number of diverse measures of the success of the organisation at generating profits.

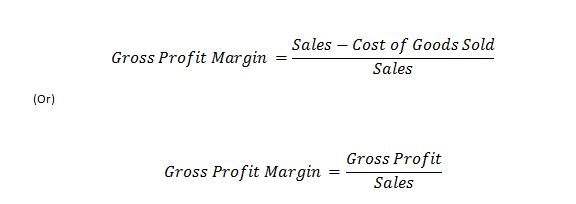

Gross profit margin (GPM):

The gross profit margin is a measure of the gross profit made on sales. The gross profit margin considers the organisations’ cost of goods sold, nonetheless does not consist of other costs. It is always a strong indication for the company to have maximum gross profit margin.

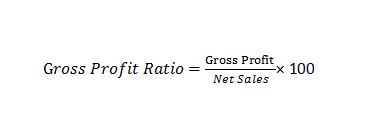

The gross profit margin is computed as follows:

The gross profit should be sufficient to cover the operating expenses and to afford for fixed expenses, dividends and building up of reserves.

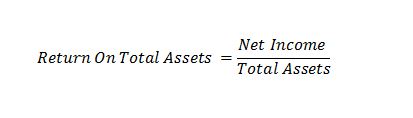

Return on total assets (ROA):

The return of on total assets, prevalently called the return on investment (ROI), measures the overall effectiveness of organisation in using its assets to produce returns or profits.

Return on total assets is defined as follows:

The sum of net income received in relation to total assets specifies how competently an organisation uses its financial Resources.

When a comParison is made of the return on total assets of one organisation to another organisation, the time period of the assets of each company should be considered. Specifically, the return on a firm’s assets will grow higher as the assets become older because the denominator will decrease each year as a result of the increase in accumulated depreciation.

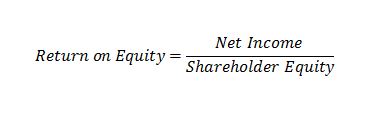

Return on equity (ROE):

Return on equity is a closely related measure for the shareholders, which measures the profits earned for each dollar/euro/pound invested in the organisation’s stock.

Return on equity is calculated as follows:

When the organisation makes a profit, even after making interest costs to creditors and giving dividends to a list of shareholders, the organisations’ use of leverage increases the return earned by average shareholder, and return on equity surpasses return on total assets.

Considering the comprehensive perspective, the profitability ratios are fundamentally categorized into two types; general profitability ratios and overall profitability ratios.

General Profitability Ratios include the following ratios:

- Gross profit ratio

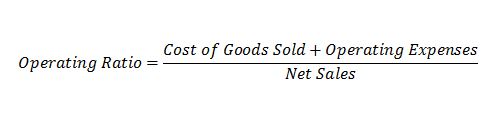

2. Operating ratio

2. Operating ratio

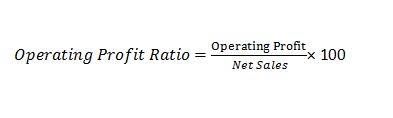

3. Operating profit ratio

3. Operating profit ratio

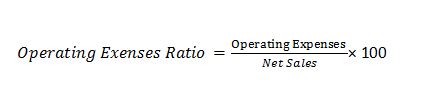

4. Expense ratio

4. Expense ratio

The operating expenses are calculated by dividing each individual operating expense (i.e., office and administration, distribution and selling etc.)

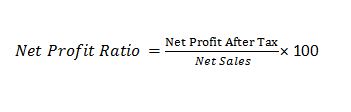

5. Net profit ratio

Overall Profitability ratios include the following ratios:

- Return on shareholders’ investment or Net Worth ratio

- Return on equity capital

- Return on capital employed

- Return on total resources

- Dividend yield ratio

- Preference dividend cover ratio

- Equity dividend cover ratio

- Price covering ratio

- Dividend pay-out ratio

- Earnings per share

Limitations of Financial Ratios

Those who practice financial ratio analysis for decision-making processes must also be conscious of its limitations. Indeed, there are several limitations that influence in contrast to their effectiveness. Those are as follows;

1. The financial analysis cannot be a factual guide to organisation’s performance as it does not help the financial analyst drive deep into operational details.

For example, if an organisation does not keep up a sound depreciation policy and announces huge profits, high profitability ratios would basically be deceptive.

2. The values of the current assets as well as amount produced change frequently which may create misrepresentations in accounting measures of performance and financial situation.

3. The reliability of the standards against which the ratios are seen, is frequently uncertain. Except the norm is consistent, any implication drawn on the basis of ratios may be deceptive.

Hence, those who deal with the ratios must supplement the financial ratio analysis with substitute implements in order to test its trustworthiness.

Concept & Definition of Accounting ?

Characteristics of Accounting ?

Key Differences Between Accounting & finance ?

basis of accounting: Cash Basis & Accrual Basis ?

Fundamental Financial Accounting Assumptions, Principles & Conventions

Core Steps in Accounting Cycle | During & End of Accounting Period

4 Financial Statements | Balance Sheet | Retained Earnings | Cash Flows

The Balanced Scorecard | Comprehensive Knowledge | Measures | Perspectives

Capital Budgeting | Definitions | Features | Process | FIVE Stages

Capital Budgeting Decisions | Criteria | Substitute Directions | Implications

Liquidity Ratios | Current Ratio | Working Capital Ratio | Quick Ratio

Financial Leverage Ratios | Debt | Total Assets | Equity | Times Interest Earned

Dividend Policy Ratios | Dividend Yield | Payout Ratio | Key Procedural Aspects