Asset Turnover Ratios | Receivables Turnover | Inventory Turnover | Total Asset Turnover | Fixed Asset Turnover

You Should Remember

Asset activity ratios or Asset turnover ratios are predominantly used by Financial experts to measure how efficiently an organisation users its assets.

The asset turnover ratios are sometimes referred to as efficiency ratios, asset utilization ratios, or asset management ratios.

The financial ratios are primarily tools for turning the date enclosed in financial statements into information used by managers and executives to better comprehend what is happening in a company.

Financial ratios are highly advantageous indicators of an organisation’s performance as well as financial environment.

Financial ratios are typically used in the process of analysing trends and also comparing the organization’s financial position to other firms.

In few instances, an effective analysis conducted by financial ratios can help to predict the forthcoming bankruptcy or economic failure.

Financial ratios can typically be grouped according to the data they make available.

You Should Remember

Financial ratios can typically be grouped according to the data they make available. However, there are a few important yet frequently used ratios as mentioned below:

Liquidity ratios,

Asset turnover ratios,

Financial leverage ratios,

Profitability ratios,

Dividend policy ratios.

Liquidity Ratios | Current Ratio | Working Capital Ratio | Quick Ratio

Financial Leverage Ratios | Debt | Total Assets | Equity | Times Interest Earned

Profitability Ratios | Gross Profit Margin | Return On Assets | Return On Equity

Dividend Policy Ratios | Dividend Yield | Payout Ratio | Key Procedural Aspects

Asset Turnover Ratios

Asset activity ratios or Asset turnover ratios are predominantly used by Financial experts to measure how efficiently an organisation users its assets.

The asset turnover ratios are sometimes referred to as efficiency ratios, asset utilization ratios, or Asset Management ratios.

Four frequently used asset turnover ratios are;

1. Receivables turnover,

2. Inventory turnover,

3. Total asset turnover; and

4. Fixed asset turnover.

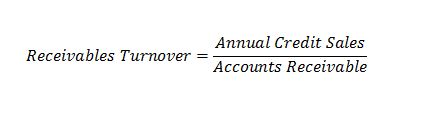

1. Receivable Turnover

Receivables turnover is a sign of how rapidly the organisation collects its accounts receivables.

The receivable turnover is calculated as follows:

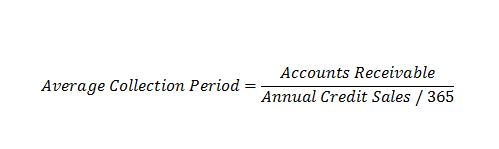

The receivables turnover frequently is stated in terms of the number of days that credit sales continue in accounts receivable before they are collected. This number is identified as the collection period.

The average collection period

It is the accounts receivable balance divided by the average day-to-day credit transactions. The average collection period ratio measures how many days, on average the company’s credit customers take to pay their accounts.

This method is frequently used by credit mangers to decide to whom the organisation should extend credit.

The average collection period is calculated as follows:

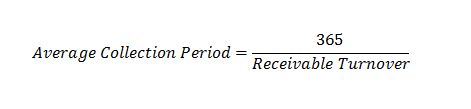

There is an additional method to define the collection period:

2. Inventory Turnover

The inventory turnover ratio is another major asset turnover. This ratio states how efficiently the organisation transforms inventory to sales. If the organisation has inventory that sells well, the ratio value will be high. If the inventory does not sell well due to lack of demand or if there is surplus inventory, the ratio value will be low.

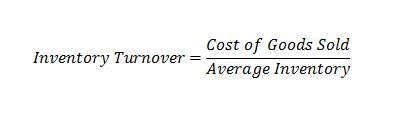

The inventory turnover is the cost of goods sold in a specific time period divided by the average inventory level during that particular period.

The inventory turnover is calculated as follows:

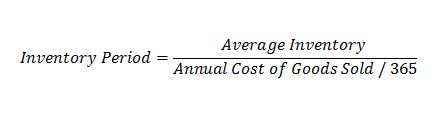

The inventory turnover is frequently referred to as the inventory period, which is calculated as follows;

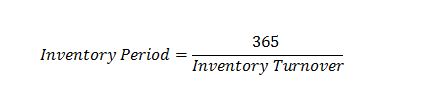

There is an additional method to define the inventory period:

3.Total Asset Turnover

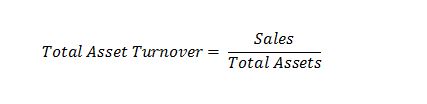

The total asset turnover ratio measures how efficiently an organisation utilizes its assets. Stockholders, bondholders, and managers know that the more efficiently the firm operates, the better the returns.

If an organisation has many assets that do not help generate sales, then the total asset turnover ratio will be relatively low. A company with a high asset turnover ratio suggests that its assets help promote sales revenue.

To calculate the asset turnover ratio, divide sales by total assets as follows:

4. Fixed Asset Turnover

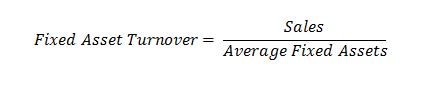

The fixed asset turnover ratio can be used to assess the appropriateness of the level of an organisation’s property, plant, and equipment.

Fixed asset turnover is calculated as sales divided by average property, plant, and equipment (fixed assets).

Limitations of Financial Ratios

Those who practice financial ratio analysis for decision-making processes must also be conscious of its limitations. Indeed, there are several limitations that influence in contrast to their effectiveness. Those are as follows;

1. The financial analysis cannot be a factual guide to organisation’s performance as it does not help the financial analyst drive deep into operational details.

For example, if an organisation does not keep up a sound depreciation policy and announces huge profits, high profitability ratios would basically be deceptive.

2. The values of the current assets as well as amount produced change frequently which may create misrepresentations in accounting measures of performance and financial situation.

3. The reliability of the standards against which the ratios are seen, is frequently uncertain. Except the norm is consistent, any implication drawn on the basis of ratios may be deceptive.

Hence, those who deal with the ratios must supplement the financial ratio analysis with substitute implements in order to test its trustworthiness.

Concept & Definition of Accounting ?

Characteristics of Accounting ?

Key Differences Between Accounting & finance ?

basis of accounting: Cash Basis & Accrual Basis ?

Fundamental Financial Accounting Assumptions, Principles & Conventions

Core Steps in Accounting Cycle | During & End of Accounting Period

4 Financial Statements | Balance Sheet | Retained Earnings | Cash Flows

The Balanced Scorecard | Comprehensive Knowledge | Measures | Perspectives

Capital Budgeting | Definitions | Features | Process | FIVE Stages

Capital Budgeting Decisions | Criteria | Substitute Directions | Implications

Liquidity Ratios | Current Ratio | Working Capital Ratio | Quick Ratio

Dividend Policy Ratios | Dividend Yield | Payout Ratio | Key Procedural Aspects