The Automotive Component Manufacturers Association Of India on 12th December 2019 released “Industry Performance 2019” report.

According to the report, the turnover of the automotive component industry that contributes 2.3 per cent to India’s GDP, 25 per cent to its manufacturing GDP and provides employment to 50 lakh people, stood at Rs.1.79 lakh crore (USD 26.2 billion) for the period April 2019 to September 2019, registering a de-growth of 10.1 per cent over the first half of the previous year.

Commenting on the performance of the auto component industry in India, Vinnie Mehta, Director General, ACMA said, “The second-half of 2018-19 saw a significant slump in vehicles sales that continued well into the first-half of 2019-20. The component industry, in tandem, posted a some-what subdued performance with de-growth of 10.1 per cent over the first half of the last fiscal, registering a turnover of Rs.1.79 lakh crore (USD 26.2 billion). Auto Component exports at Rs.51,397 crore (USD 7.5 billion) remained stable with a moderate growth of 2.7 percent, the Aftermarket also witnessed growth of 4 per cent scaling to Rs.35,096 crore (USD 5.1 billion) however, sales to OEMs in the domestic market at Rs.1,50,743 crore (USD 22 billion) declined 15.2 per cent”.

Sharing his insights on the downturn in the auto component industry, Deepak Jain, President, ACMA said, “The automotive industry is facing a prolonged slowdown. The vehicle sales in all segments have continued to plummet for the last one year. Considering the auto component industry grows on the back of the vehicle industry, a current 15 to 20 per cent cut in vehicle production has inter-alia adversely impacted the auto components industry performance and investments. Going forward, with transition to BSVI and implementation of safety norms, the value-addition from the component industry is expected to progressively increase.”

Subdued vehicle demand, recent investments made for transition from BSIV to BSVI, liquidity crunch, lack of a clarity on policy for electrification of vehicles, among others, have also had an adverse impact on the expansion plans of the component sector, the report stated.

Speaking about the need for government intervention to sustain long-term growth in the Auto Component industry, Jain added, “One of the key recommendations of the industry has been a uniform 18% GST rate across the auto component sector; currently 60 per cent of the auto components attract 18 per cent GST rate, while the rest 40 per cent, majority of which are two-wheelers and tractor components, attract 28 per cent. The latter high rate has led to flourishing grey operations in the aftermarket. A benign rate of 18 per cent will not only ensure better compliance but will also ensure a larger tax base. That apart, revision in the definition of the MSMEs from one based on investment in plant and machinery to that on turnover, has been a long-standing request of the industry. Considering MSMEs constitute over seventy percent of the auto component industry, a change in the definition will enable a wider section of the industry avail government incentives.”

Key findings of the ACMA Industry Performance Review for 2019-20.

Exports: Exports of auto components grew by 2.7 per cent to Rs.51,397 crore (USD 7.5 billion) in H1 2019-20 from Rs 50,034 crore (USD 7.3 billion) in H1 2018-19. Europe accounted for 32 per cent of exports followed by North America and Asia, with 30 per cent and 26 per cent respectively.

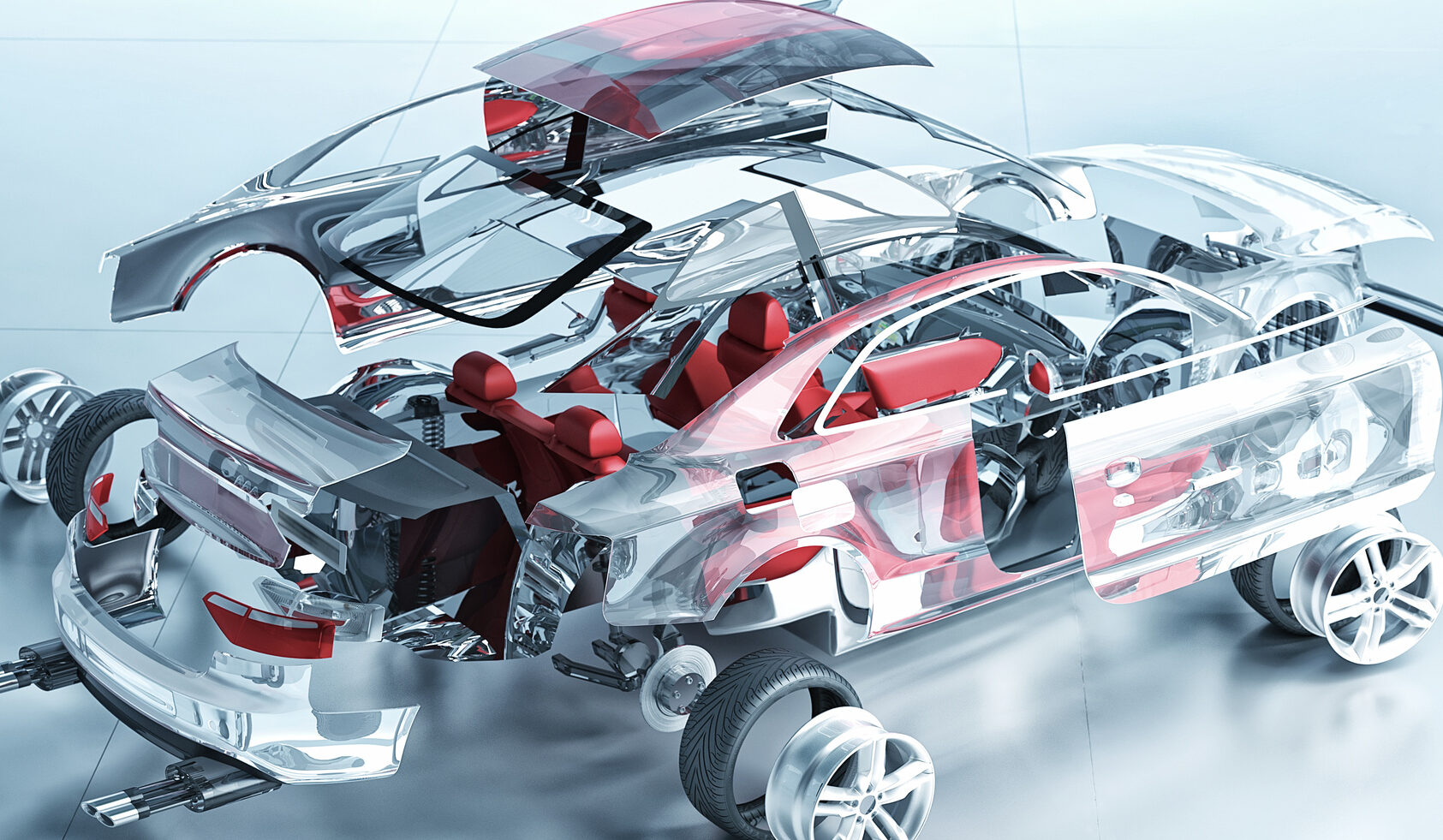

The key export items included drive transmission & steering, engine components, Body/Chasis, Suspension & Braking etc.

Imports: Imports of auto components decreased by 6.7 per cent to Rs.57,574 crore (USD 8.4 billion) in H1 2019-20 from Rs.61,686 crore (USD 9.0 billion) in H1 2018-19. Asia accounted for 62 per cent of imports followed by Europe and North America, with 28 per cent and 8 per cent respectively.

Aftermarket: The aftermarket in H1 2019-20 grew by 4 per cent to Rs 35,096 crore (USD 5.1 billion) from Rs.33,746 crore (USD 4.9 billion) in H1 2018-19.