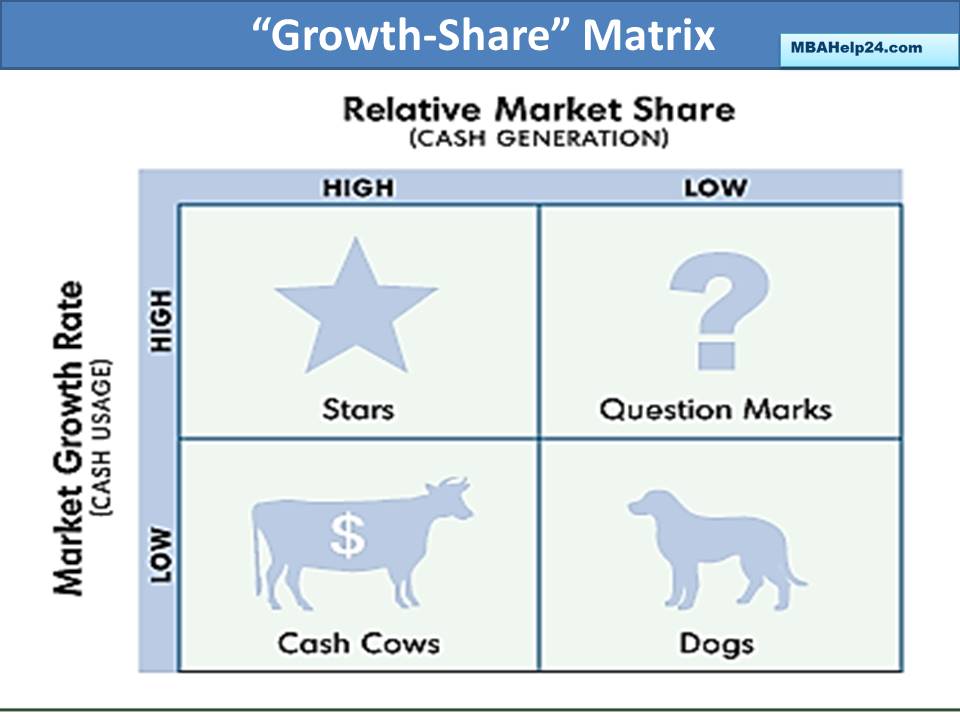

The BCG ( Boston Consulting Group) matrix organizes businesses along two dimensions – business growth rate and market share.

The BCG ( Boston Consulting Group) matrix organizes businesses along two dimensions – business growth rate and market share.

Business growth rate relates to how aggressively the whole industry is thriving.

Market share determines whether a business enterprise has a larger or smaller share than rivals.

The combinations of high and low market share and high and low business growth present four categories for a corporate portfolio.

The BCG matrix provides a framework for assigning resources involving various business units in addition to enables one to compare a wide selection of business units at a glance.

The star has a large market share in a rapidly growing industry. The star is important and vital for the reason that it features added growth potential, and profits ought to be ploughed into this business as investment with regard to foreseeable future development and profits. The star is noticeable as well as appealing and will eventually generate profits and also a strong cash flow even as the industry matures and market growth drops.

The cash cow happens to be in a mature, slow-growth industry but is a dominant business in the industry, possessing a weighty market share. For the reason that large investments in advertising and business unit expansion are no longer necessary, the business earns an attractive cash flow. It can certainly milk the cash cow to invest in some other, riskier businesses.

The question mark exists in a new, aggressively growing industry, but possesses only a limited market share. The question mark business is risky or expensive: it may perhaps turn out to be a star, or it could crash. The organization can invest the cash earned coming from cash cows in question marks with the purpose of growing them into future stars.

The dog is an inadequate performer. It possesses only a little share of a sluggish growth market. The dog allows for small profit for the organization and may be aimed for divestment or liquidation in the case turnaround is not achievable.

The BCG matrix provides a framework for assigning resources involving various business units in addition to enables one to compare a wide selection of business units at a glance.

On the other hand, the strategy has brought some unfavourable criticism for the following explanations:

- The connection concerning market share and profitability is doubtful for the reason that rising market share can be hugely expensive.

- The method can potentially overemphasize bigger growth, since it ignores the potential of suffering markets.

- The approach considers market rate of growth to be a provided. In reality the organization could possibly grow the market.

Competitive Advantage: Cost Advantage & Differentiation

A Model of Competitive Advantage

Five Forces Model: Summary, Significance & Framework

Using The Five Forces Model In Industry Analysis

Generic Strategies: Concept, Framework, Performance & Risk

The Value Chain: Features, Phases, Merits & Limitations